- 2016 TAX EXTENSION FORM PRINTABLE CODE

- 2016 TAX EXTENSION FORM PRINTABLE PLUS

- 2016 TAX EXTENSION FORM PRINTABLE DOWNLOAD

- 2016 TAX EXTENSION FORM PRINTABLE FREE

Note: Interest applies to any balance of tax due that is not paid by the due date of a return, even if the return is filed under extension. Please note that the interest applies to any balance of tax due that is not paid by the due date of a return, even if the return is filed under extension. The rate shall apply for the calendar year next following the July of the year in which the federal short-term rate is determined.

2016 TAX EXTENSION FORM PRINTABLE PLUS

The interest rate used shall be the federal short-term rate (rounded to the nearest whole number percent) plus five percent (5%). Interest shall be imposed per annum, on all unpaid income tax, unpaid estimated income tax and unpaid withholding tax.

2016 TAX EXTENSION FORM PRINTABLE CODE

Ohio Revised Code Section 718.27 requires the Tax Administrator to publish the established interest rate to tax underpayments based on the federal short-term rate that will apply during the next calendar year. The penalty shall not exceed $150.00 for each return not filed timely. This is a one time assessment per return.Ī penalty may be imposed on the unpaid withholding tax balance equal to fifty percent (50%) of the amount not timely paid.Ī penalty may be imposed on a municipal income tax return, other than an estimated income tax return, not filed timely, of twenty-five ($25.00) each month or any fraction, during which the return remains unfiled regardless of the liability. A 15% penalty may be imposed for failure to pay the required estimated tax payments. Taxes paid after the due date are subject to a 15% late payment penalty. This section applies to any return required to be filed under applicable law for taxable years beginning on or after January 1, 2016, and for income tax, estimated income tax, and withholding income tax required to be paid or remitted to the City of Massillon on or after Janufor taxable years beginning on or after January 1, 2016. If the request is received by the tax administrator on or before the date the municipal income tax return is due, the tax administrator shall grant the taxpayer’s requested extension.Īn extension of time to file under this chapter is not an extension of the time to pay any tax due unless the Tax Administrator grants an extension of that date. To avoid a late filing penalty it is recommended that the tax payer attach a copy of the extension to the return when it is filed.Ī taxpayer that has not requested or received a six-month extension for filing the taxpayer’s federal income tax return may request that the tax administrator grant the taxpayer a six-month extension of the date for filing the taxpayer’s municipal income tax return. The extended due date of the municipal income tax return shall be the fifteenth day of the tenth month after the last day of the taxable year to which the return relates. For taxpayers – extensions to file:Īny taxpayer that has duly requested an automatic six-month extension for filing the taxpayer’s federal income tax return shall automatically receive an extension for the filing of a municipal income tax return.

2016 TAX EXTENSION FORM PRINTABLE DOWNLOAD

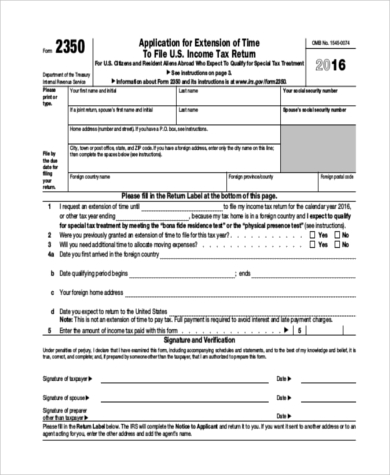

Please note: Some web browsers attempt to open PDFs using their own reader plug-ins, which may impair functionality of the fillable form.įor best results, we recommend that you first download the form by right-clicking on its link and choosing “Save As.”, and then opening the downloaded form in the newest version of Adobe Acrobat Reader.Īnnual Final Return is due within 4 months of the end of the fiscal year. A window will open up in Adobe Acrobat Reader and allow you to save the form in a directory of your choice, or you can send the form directly to your printer by clicking on the “print” button.

Decide on which form you need, and click on it. Once Adobe Acrobat Reader is installed, you can now proceed with printing the requested forms.

2016 TAX EXTENSION FORM PRINTABLE FREE

To download a FREE version, click Adobe Acrobat Reader.

In order to read or print forms, you must have Adobe Acrobat Reader installed on your computer. The following forms are provided to you by the City of Massillon Income Tax Department, and can be downloaded to your computer or printed.

0 kommentar(er)

0 kommentar(er)